Whitecap Consulting’s consumer and retail expert Ruth Irving reflects on the challenge of launching a successful consumer product in 2016, and offers six key insights based on Whitecap’s recent assignments.

Successfully launching a new consumer product in 2016 is probably a more challenging process than it has ever been before. The huge amount of marketing noise – digitally and in more traditional channels – plus the sheer number of products and brands a consumer can choose from, makes it a tall order to make your mark.

As part of a recent project, we came across two reports that analyse and discuss different perspectives on marketing strategies for consumer markets.

- The first, Nielsen’s Breakthrough Innovation report was published in December 2015 and analysed 8,650 consumer product launches across Western Europe. This report presents a range of relevant case studies, casting insight into consumer marketing strategies.

- The second report, Consumer Product Trends – Navigating 2020, published by Deloitte University Press also in 2015, is an amalgamation of several surveys including research (based in the US) with 4,000 consumers and interviews and 85 executives. This report looks at warnings in the consumer sector and discusses uncertainties to identify and consider.

There are many factors to consider when launching a product into consumer markets, so I have picked out 6 key elements for anyone making an assessment of market opportunities and creating a go-to-market-strategy.

1. Accumulate demand driven insights

Nielsen says “great demand-driven insights often come from simple observations of reasons why people don’t use a product. What causes them stress, confusion or inconvenience.”

If you resolve these you uncover emerging or latent demand.

They give as an example the breakthrough innovation of Scholl Velvet Smooth Express Pedi; “Once we started listening to consumers about their foot care routines, we found many – particularly women – had unmet needs in their regular care regime,” said John Segar, CMI director, health care at RB – which bought Scholl. “Most people get hard skin on their feet. But the solution hadn’t really been improved for 100 years.”

2. Observe where consumer needs are heading

The Deloitte report looks at uncertainties in the consumer market and the impact of these on new product development. They say the majority of consumers (74 per cent) are paying close attention to the nutritional content of the foods they buy and try to avoid preservatives and chemicals. Catering to today’s definition of healthy products has potential for premium prices – as an example, 16 per cent of consumers will pay a 10 per cent premium or more for healthier versions of products.

Brands need to reinvent themselves and reformulate their products on these lines to ensure continuing brand loyalty.

3. Listen to your customers

Nielsen talks about how essential consumer feedback is to ensure relevance, differentiation and superiority. It helps prioritise strong initiatives and removes weak ones, confirms fit with strategic objectives and volumetric potential.

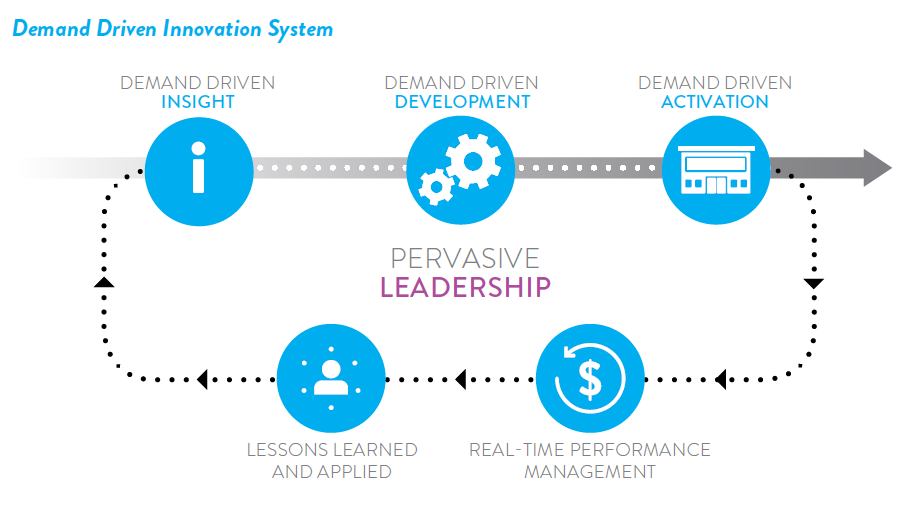

This is their model of demand driven innovation.

4. Utilise all kinds of data

To develop a brand story, the Nielsen report says you need the stories and ‘small’ insights as well as the volume of big data. They point out that there is a popular misconception that ‘Qualitative data are subjective, and quantitative data are objective’.

Stefan Müller, marketing director and board member of Eckes-Granini Germany explained how they developed the Granini brand – another breakthrough innovation product.

“The juice market is under pressure, the main usage occasion, traditional in-home family

“The juice market is under pressure, the main usage occasion, traditional in-home family

breakfast, is becoming less relevant in modern times. It was very important to us to be open, unassuming and eager to understand and learn all the time.

“Through a consumer segmentation study, we looked at all occasions of drinking non-alcoholic beverages, conducted a share of throat analysis for all drinks from milk to non-alcoholic beer. We then explored deep underlying motivations and needs of various consumer segments. “

Müller added: “It was important to us, we connected with the consumer in many different ways to understand market structures, needs and competitive landscape through our consumers’ eyes. If you take a step back and don’t think about the juice market but about consumers drinking non-alcoholic beverages throughout the day, a huge market and tons of potential opportunities arise.

“In the end, we realised that within the 2 billion liter lemonade market there was an under-served consumer segment. A group we call ’urban authentics’ longing for refreshment that is fun but also grown up and delivers seriously on taste. This group was currently not having their needs met in the lemonade aisle.”

5. Match customer insights to all parts of your product activation

Nielsen talks about successful activation that focuses back on the customer insights and brings the product to life. Good ‘activation’ leverages creative execution, packaging design, point of sale and a wide range of consumer engagement tactics to help consumers make the connection between a new product and the issue that the product is solving.

Dr Maria Langhals, corporate director, global research and development skin care at Beiersdorf talks about the activation of the new Nivea anti-ageing brand, Cellular – another on the Nielsen Breakthrough Innovation list

Dr Maria Langhals, corporate director, global research and development skin care at Beiersdorf talks about the activation of the new Nivea anti-ageing brand, Cellular – another on the Nielsen Breakthrough Innovation list

“We went very broad, very quickly but only in countries ready for the launch,” said Dr Langhals. “It was the key launch of the year for the company, with full management attention throughout the company—not only with marketing but also POS, sales, the digital team, shopper customer team, distribution speed up, hero placements at POS, secondary placement, press conferences, PR events, a big event in London, lots of events close together. The message was really out.”

Their innovation strategy is to define just a few key innovations and sustainably support these

6. Use digital to influence the in-store purchase

The Deloitte report looks at a number of areas of uncertainty that strategies need to address – and digital is both a threat and an opportunity (this guest blog on our site looks in more detail at creating a strategy for an uncertain future).

Their report talks about the uncertainty in the new marketing channels to reach consumers, the convergence of sales and marketing environments, and the growth of disruptive retail models emerging. Traditional bricks-and-mortar business models may be dismantled as consumers fully embrace digital.

In summary

The key to successful innovation today is that products need many more paths to the consumer and many more convenient options for consumers to make initial and recurring purchases. Consumers now to be more involved and better understood in their customer journey, this means involving their opinions, fully understanding them to deliver something personalised and utilising and aligning all possible channels.