The UK’s approach to financial regulation has been key in enabling a dynamic financial services sector that supports and drives the economy, enables a progressive economic outlook, creates jobs, and plays a significant role as a global financial service centre.

The development of this Roadmap highlighted financial regulation as a priority theme because of its fundamental role in FinTech and financial services, as well as the need for financial regulation to support the positive role FinTech innovation could play in the future of finance.

Regulation remains extremely complex for all those operating in the finance industry. Depending on the complexity of the financial institution’s business model, meeting compliance obligations can mean significant costs.

Industry research suggests that some of the largest global financial institutions are spending up to 5% of revenue on regulatory compliance. Across the UK this could mean the annual cost of demonstrating regulatory compliance is as much as £6.6 billion.

Throughout the development of the Roadmap, contributors highlighted their interest in the role technologies could play in future financial regulation. Some examples are AI, advanced analytics, high performance computing including quantum computing, and distributed ledger technologies.

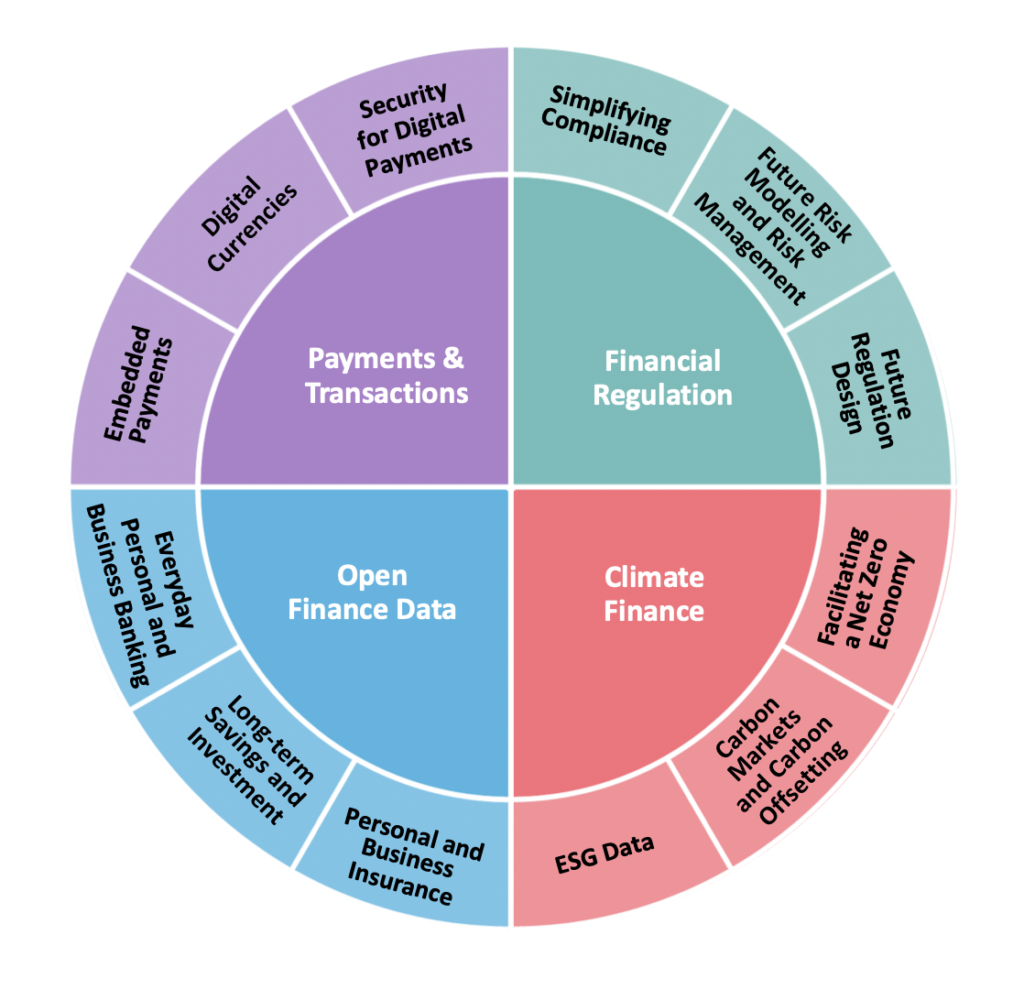

Priority areas in Financial Regulation

The industry contributors to this roadmap offered a view that the future looks set for significantly more change. Our analysis highlighted three topics of interest:

Simplifying compliance

Helping financial institutions create new solutions and use FinTech to help meet current, continuously changing, and global regulatory obligations.

Future risk modelling and risk management

Reinventing risk management with technology and data analytics, and enabling new approaches to fight financial crime, address fraud and focus on emerging climate risks.

- Reinventing risk management with technology and data analytics

- Enabling new approaches to address fraud and fight financial crime

- Modelling for new and emerging climate risks

Future regulation design

Enabling an agile regulatory framework that works for all, and developing future regulatory oversight or supervisory technology.

- Regulatory reporting

- Interoperability and data standardisation

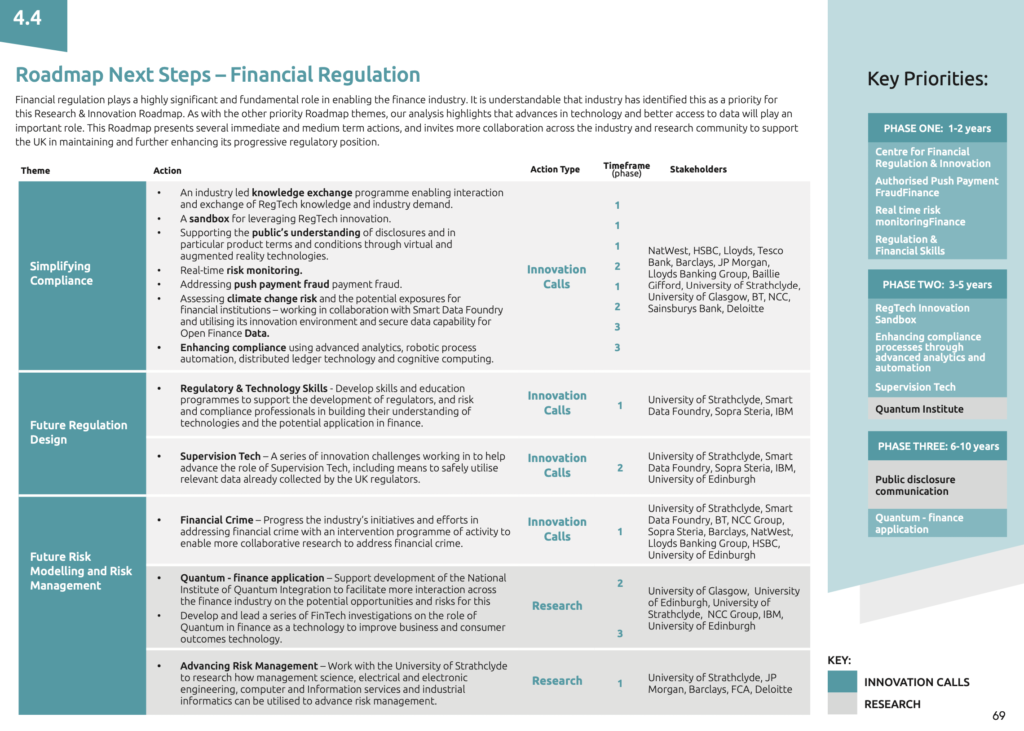

Roadmap next steps: Financial Regulation

A range of proposed next steps are laid out in the published Roadmap, which specifically identifies 13 actions relating to Financial Regulation, and categorises each into one of three phases over the next 10 years. These actions are illustrated in the graphic below. The report also references 23 different stakeholders who can support the implementation of these actions, which are broken down into research projects and innovation calls.

More information about FinTech Scotland’s Research & Innovation Roadmap can be found here, where the full Roadmap can also be downloaded.