The research project, undertaken by Whitecap Consulting and co-published with Innovate Finance and Streets Consulting, was designed to answer a fundamental question for the FinTech industry and the wider UK economy: How do we enable more FinTech firms to successfully scale up in the UK?

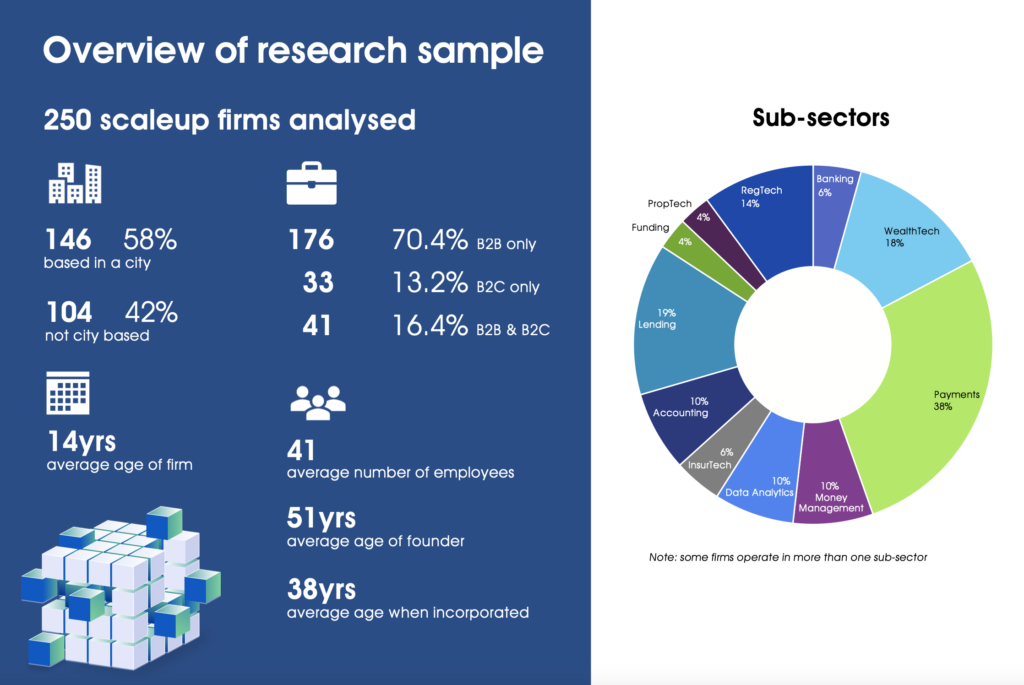

The ‘Scaling UK Regional FinTech’ research report delves into the growth and development data of 250 of the UK’s regional FinTech scaleups outside of London and is supported by interviews with leaders and entrepreneurs. It reveals the challenges and opportunities FinTech scaleups face as they grow, navigate the current economic climate and strive to bring the innovation and growth that the UK economy needs.

Report Findings:

People

- Firms with female founders achieved over 30% more turnover growth than those with male only founders – yet only 16% of firms had a female founder.

- More than half of FinTechs had more than one founder; the average age of all founders is 38 years old.

- The more founders, the higher their revenue growth rate (companies with up to 4 founders were part of the study).

Money

- Raising investment correlates to higher employee and revenue growth, but revenue grows at a proportionally lower rate.

- 9 out of 10 firms that attended an accelerator went on to raise funding.

- Firms in Payments and WealthTech account for the largest number of scaleups, but PropTech firms are most likely to successfully raise funding.

Market

- 87% of FinTechs analysed have a B2B element to their go to market strategy, compared to 30% B2C (16% have both).

- On average, B2C firms that obtain funding achieved double the revenue and employee growth of B2B only firms.

- Firms in Lending, Banking, InsurTech, Money Management and WealthTech enjoy the strongest revenue growth.

Recommendations from the report

Based on the analysis and interviews undertaken during the research report, the evidence suggests the following actions would help create more FinTech scaleups across the UK:

For entrepreneurs:

- Vocation, not location. What you do and how you do it will define your success, not your location.

- Don’t go it alone. FinTech firms with multiple founders are more likely to successfully scale.

- Ensure gender diversity. Firms with one or more female founders outperform male-only founder teams.

- Join an accelerator. Companies which were part of an accelerator raised investment more successfully; the coaching, guidance and contacts within accelerator cohorts can provide assistance as organisations scale.

For investors, policymakers and the wider FinTech sector:

- Think nationally. Our analysis shows that location doesn’t matter, although being in a city has a positive impact on growth.

- Reduce risk for entrepreneurs. More support is required in terms of tax relief schemes and access to funding.

- Encourage diversity in FinTech leadership. More initiatives are required, building on the new government taskforce to create dedicated funding for female-founded businesses and to provide support for other challenges faced by female entrepreneurs.

Download the report

We are very grateful to the FinTech founders and CEOs from across the UK who gave their time to contribute to this report via 1-1 interviews:

The organisations behind this report are actively engaged with key regional FinTech groups that are playing a vital role in the development of regional FinTech across the UK: